Intel Reports Second-Quarter Revenue of $13.8 billion

Intel Reports Second-Quarter Revenue of $13.8 billion

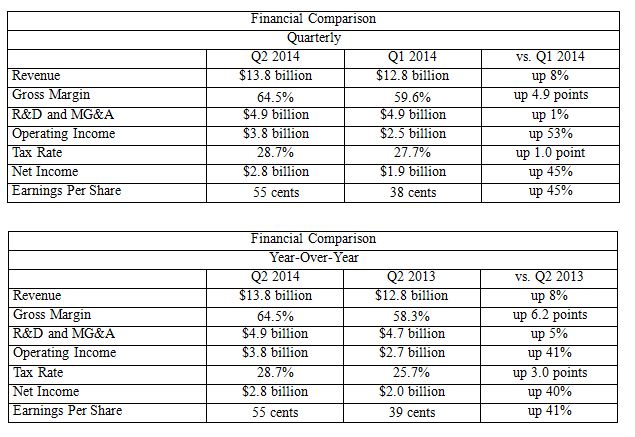

SANTA CLARA, Calif., July 15, 2014 — Intel Corporation today reported second-quarter revenue of $13.8 billion, operating income of $3.8 billion, net income of $2.8 billion and EPS of $0.55. The company generated approximately $5.5 billion in cash from operations, paid dividends of $1.1 billion, and used $2.1 billion to repurchase 74 million shares of stock.

“Our second-quarter results showed the strength of our strategy to extend the reach of Intel technology from the data center to PCs to the Internet of Things,” said Intel CEO Brian Krzanich. “With the ramp of our Baytrail SoC family, we have expanded into new segments such as Chrome-based systems, and we are on track to meet our 40 million unit tablet goal. In addition, we hit an important qualification milestone for our upcoming 14nm Broadwell product, and expect the first systems to be on shelves during the holidays.”

Intel announced that it intends to return more cash to shareholders by lowering its cash balance further through increased share repurchases. The board of directors authorized an increase of $20 billion to its share repurchase program and the company is forecasting share repurchases of approximately $4 billion in the third quarter, with additional share repurchases in the fourth quarter. Over the last decade Intel has returned almost $90 billion to shareholders through dividends and share repurchases.

“This change in our capital structure is the continuation of a multi-year focus on creating value and returning cash to our shareholders, and reinforces our confidence in the business,” said Stacy J. Smith, Intel CFO and executive vice president.

Q2 Key Business Unit Trends

- PC Client Group revenue of $8.7 billion, up 9 percent sequentially and up 6 percent year-over-year.

- Data Center Group revenue of $3.5 billion, up 14 percent sequentially and up 19 percent year-over-year.

- Internet of Things Group revenue of $539 million, up 12 percent sequentially and up 24 percent year-over-year.

- Mobile and Communications Group revenue of $51 million, down 67 percent sequentially and down 83 percent year-over-year.

- Software and services operating segments revenue of $548 million, down 1 percent sequentially and up 3 percent year-over-year.

Business Outlook

Intel’s Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after July 15.

Q3 2014

- Revenue: $14.4 billion, plus or minus $500 million.

- Gross margin percentage: 66 percent, plus or minus a couple of percentage points.

- R&D plus MG&A spending: approximately $4.9 billion.

- Restructuring charges: approximately $20 million.

- Amortization of acquisition-related intangibles: approximately $65 million.

- Impact of equity investments and interest and other: approximately zero.

- Depreciation: approximately $1.9 billion.

- Tax rate: approximately 28 percent.

Full-Year 2014

- Revenue: growth of approximately 5 percent, slightly higher than prior expectations.

- Gross margin percentage: 63 percent, plus or minus a few percentage points, in line with prior expectations.

- R&D plus MG&A spending: $19.3 billion, plus or minus $200 million, higher than prior expectations of $19.2 billion.

- Amortization of acquisition-related intangibles: approximately $300 million, unchanged from prior expectations.

- Depreciation: approximately $7.4 billion, unchanged from prior expectations.

- Tax rate: each of the remaining quarters of 2014 is still expected to be approximately 28 percent, unchanged from prior.

- Full-year capital spending: $11.0 billion, plus or minus $500 million, unchanged from prior expectations.

For additional information regarding Intel’s results and Business Outlook, please see the CFO commentary at: www.intc.com/results.cfm.

About Intel

Intel (NASDAQ: INTC) is a world leader in computing innovation. The company designs and builds the essential technologies that serve as the foundation for the worlds computing devices. As a leader in corporate responsibility and sustainability, Intel also manufactures the worlds first commercially available conflict-free microprocessors.