Amazon To Design Own Processors With ARM License?

Word on the street is that Amazon is looking to make their own silicon solutions after it has been discovered that the corporation is hiring former chip designers from Calxeda and had online job postings for chip architects. Joining server tech forerunners Google and Facebook, Amazon may be looking to license their own ARM design for internal servers. Such manufacturing is no doubt a multi-million dollar undertaking, but with the financial backing of the web giant’s online retailing, cloud provisions, and the flourishing Kindle ecosystem, it seems like a reasonable step. Particularly with the impending release of the Kindle phone (Check out images here), Amazon could be looking to make their own chips in order to acquire full independence from external chip manufacturers. Internal chip design would also sidestep a similar situation to Apple’s reliance on Samsung-produced A7 processors. The only hiccup would be that Amazon would be reliant on the chip fab that they would hire on to make their processor/s.

Aside from purchase costs, ARM brings major SoC efficiency in an area that desperately needs it. Farms running thousands of virtual machines or Amazons massive data infrastructure could lower energy costs and reduce their carbon footprint. ARM hopes to gain significant market share in server market and hopes to be the architecture used in server nodes. The image below shows a 14-node server cluster by Applied Micro with X-Gene processors based on the ARMv8 64-bit architecture that is running Ubuntu 14.04 LTS.

Beyond the server realm, internal ARM production could expand to Amazon’s mobile offerings. Severing ties with Qualcomm would cut costs across the board, lowering production cost and perhaps even consumer cost.

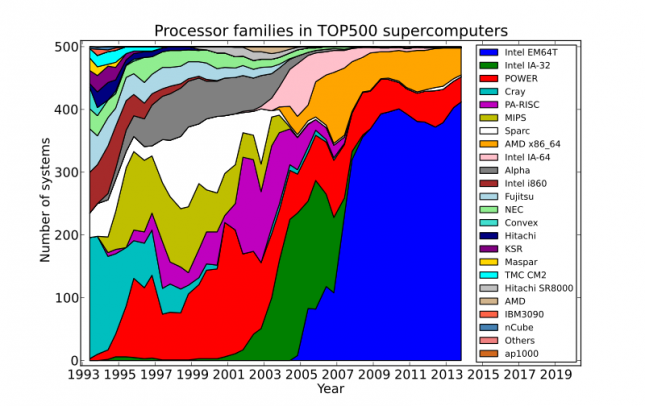

Overall, the move away from x86 doesn’t bode well for Intel. Desktop PC sales are still trending down, AMD is pushing out their own 64-bit ARM server SoC, and even Microsoft has a dedicated ARM build. Intel is a little late to the game on low power solutions, with Bay Trail coming perhaps too little too late. With 80% of TOP500 supercomputers running on Intel CPUs, a major shift in the market could spell major issues for the reigning processor champion.

Industry focus is shifting away from a need for power and toward responsibility in green computing. And if large scale companies come out of that switch with less overhead costs, it may be that Intel has seen it’s better days as it throws billions of dollars at R&D to try and stay relevant.