BlackBerry Reports Third Quarter Fiscal 2014 Results – $4.4 Billion Loss

BLACKBERRY REPORTS THIRD QUARTER RESULTS FOR FISCAL 2014

Waterloo, ON BlackBerry Limited (NASDAQ: BBRY; TSX: BB), a global leader in wireless innovation, today reported financial results for the three months ended November 30, 2013 (all figures in U.S. dollars and U.S. GAAP, except where otherwise indicated).

Q3 Highlights:

- Company begins transition to operating unit structure: Enterprise Services, Messaging, QNX Embedded business and the Devices business

- New organizational structure to drive greater focus on services and software, while establishing a more efficient business model for the Devices business

- Enterprise Services: Company sees increasing penetration of BlackBerry Enterprise Service 10 (BES10) with over 30,000 commercial and test servers installed to date, up from 25,000 in September 2013; Company remains a mobile device management leader with global enterprise customer base exceeding 80,000

- Messaging: Over 40 million newly registered iOS/Over 40 million newly registered iOS/Android users in the last 60 days; more than a dozen Android OEMs to preload BBM, including most recently LG; over 250,000 BBM Channels created by global user base since launch of BBM Channels on BlackBerry, including large brands such as Coke Indonesia and USA Today; BBM is the most secure mobile messaging service for use in regulated enterprises

- QNX Embedded Business: QNX to unveil new technology in automotive and cloud services at the 2014 International Consumer Electronics Show in January

- Devices: Company strikes joint device development and manufacturing agreement with Foxconn; initial focus of partnership to be development of a consumer smartphone for Indonesia and other fast-growing markets in early 2014

- Revenue for the third quarter of approximately $1.2 billion, compared to $1.6 billion in the previous quarter; Company recognizes revenue on approximately 1.9 million smartphones in the third quarter, compared to 3.7 million smartphones in the previous quarter

- Company takes primarily non-cash, pre-tax charges of $4.6 billion associated with long-lived assets, inventory and supply commitments, and previously announced restructuring and strategic review process; GAAP loss from continuing operations of $4.4 billion, or $8.37 per share diluted, compared with a GAAP loss from continuing operations of $965 million, or $1.84 per share diluted, in the prior quarter

- Adjusted loss from continuing operations for the third quarter, excluding charges, was $354 million, or $0.67 per share diluted, compared with adjusted loss from continuing operations of $248 million, or $0.47 per share diluted, in the prior quarter

- Cash and investments balance of $3.2 billion; cash used in operations of $77 million

Q3 Results

Revenue for the third quarter of fiscal 2014 was approximately $1.2 billion, down $380 million or 24% from approximately $1.6 billion in the previous quarter and down 56% from $2.7 billion in the same quarter of fiscal 2013. The revenue breakdown for the quarter was approximately 40% for hardware, 53% for services and 7% for software and other revenue. During the third quarter, the Company recognized hardware revenue on approximately 1.9 million BlackBerry smartphones compared to approximately 3.7 million BlackBerry smartphones in the previous quarter. Most of the units recognized were BlackBerry 7 devices. During the quarter, approximately 4.3 million BlackBerry smartphones were sold through to end customers, which included shipments made and recognized prior to the third quarter and which reduced the Companys inventory in channel. Of the BlackBerry smartphones sold through to end customers in the third quarter, approximately 3.2 million were BlackBerry 7 devices.

GAAP loss from continuing operations for the quarter was $4.4 billion, or $8.37 per share diluted. The loss includes a non-cash, pre-tax charge against long-lived assets of approximately $2.7 billion (the LLA Impairment Charge), a primarily non-cash, pre-tax charge against inventory and supply commitments of approximately $1.6 billion (the Q3 14 Inventory Charge), and pre-tax restructuring, legal and financial advisory charges of approximately $266 million related to the Cost Optimization and Resource Efficiency (CORE) program and the strategic review process. This compares with a GAAP loss from continuing operations of $965 million, or $1.84 per share diluted in the prior quarter, and GAAP income from continuing operations of $14 million, or $0.03 per share diluted, in the same quarter last year.

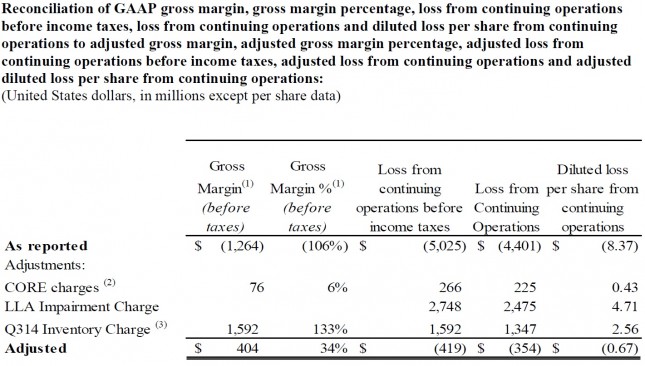

Adjusted loss from continuing operations for the third quarter was $354 million, or $0.67 per share diluted. Adjusted loss from continuing operations and adjusted diluted loss per share exclude the impact of the LLA Impairment Charge of approximately $2.7 billion ($2.5 billion after tax), the Q3 14 Inventory Charge of approximately $1.6 billion ($1.3 billion after tax) and pre-tax restructuring and legal and financial advisory charges of approximately $266 million ($225 million after tax) related to the CORE program and strategic review process incurred in the third quarter of fiscal 2014. These impacts on GAAP loss from continuing operations and diluted loss per share from continuing operations are summarized in the table below.

The total of cash, cash equivalents, short-term and long-term investments was $3.2 billion as of November 30, 2013, compared to $2.6 billion at the end of the previous quarter. Cash flow used in operations in the third quarter was approximately $77 million. Cash flows provided by financing activities in the third quarter were approximately $991 million, including the proceeds from the issuance of debt. Uses of cash included intangible asset additions of approximately $234 million and capital expenditures of approximately $46 million. Purchase obligations and commitments amounted to approximately $2.1 billion as at November 30, 2013, with purchase orders with contract manufacturers representing approximately $664 million of the total.

With the operational and organizational changes we have announced, BlackBerry has established a clear roadmap that will allow it to target a return to improved financial performance in the coming year, said John Chen, Executive Chairman and Chief Executive Officer of BlackBerry. While our Enterprise Services, Messaging and QNX Embedded businesses are already well-positioned to compete in their markets, the most immediate challenge for the Company is how to transition the Devices operations to a more profitable business model.

Chen added: We have accomplished a lot in the past 45 days, but still have significant work ahead of us as we target improved financial performance next year. However, the Company is financially strong, has a broad and trusted product portfolio to work with, a talented employee base and a new leadership team dedicated to implementing our new roadmap.

BlackBerry Announces Five-Year Strategic Partnership with Foxconn

The Company announced today that it has entered into a five-year strategic partnership with Foxconn, the worlds largest manufacturer of electronic products and components. Under this new relationship, Foxconn will jointly develop and manufacture certain new BlackBerry devices and manage the inventory associated with those devices. The initial focus of the partnership will be a smartphone for Indonesia and other fast-growing markets targeting early 2014.

This partnership demonstrates BlackBerrys commitment to the device market for the long-term and our determination to remain the innovation leader in secure end-to-end mobile solutions, said Chen. Partnering with Foxconn allows BlackBerry to focus on what we do best iconic design, world-class security, software development and enterprise mobility management while simultaneously addressing fast-growing markets leveraging Foxconns scale and efficiency that will allow us to compete more effectively.

BlackBerry will own all of its intellectual property and perform product assurance on devices through the Foxconn partnership, as it does currently with all third-party manufacturers.BlackBerry is an iconic brand with great technology and a loyal international fan base, said Terry Gou, Founder and Chairman, Foxconn. We are pleased to be working with BlackBerry as it positions itself for future growth and we look forward to a successful strategic partnership in which Foxconn will jointly develop and manufacture new BlackBerry devices in both Indonesia and Mexico for new and existing markets.

BlackBerry will focus heavily, via internal development, on market segments where its continuous innovations in secure hardware, software and services remain critical and integral to enterprise and government customers. BlackBerry also intends to drive adoption of its multi-platform BBM, deliver real-time, reliable and secure messaging through its Network Operations Center (NOC), and grow its enterprise mobility and mobile device management business through on-premise and cloud-based solutions for cross-platform devices as well as its own.

Outlook

In the fourth quarter, the Company anticipates maintaining its strong cash position and further reducing operating expenses as it continues to implement its previously-announced cost reduction program.Conference Call and Webcast

A conference call and live webcast will be held beginning at 8 am ET, which can be accessed by dialing 1-800-814-4859 or through your BlackBerry 10 smartphone, personal computer or BlackBerry PlayBook tablet at http://ca.blackberry.com/company/investors/events.html. A replay of the conference call will also be available at approximately 10 am by dialing (+1)416-640-1917 and entering pass code 4612570# or by clicking the link above on your BlackBerry 10 smartphone, personal computer or BlackBerry PlayBook tablet. This replay will be available until midnight ET January 3, 2014.

About BlackBerry

A global leader in wireless innovation, BlackBerry revolutionized the mobile industry when it was introduced in 1999. Today, BlackBerry aims to inspire the success of our millions of customers around the world by continuously pushing the boundaries of mobile experiences. Founded in 1984 and based in Waterloo, Ontario, BlackBerry operates offices in North America, Europe, Asia Pacific and Latin America. BlackBerry is listed on the NASDAQ Stock Market (NASDAQ: BBRY) and the Toronto Stock Exchange (TSX: BB). For more information, visit www.blackberry.com.