Intel Reports Record Full-Year Revenue of $55.9 Billion

Intel Reports Record Full-Year Revenue of $55.9 Billion, Generates Net Income of $11.7 Billion, Up 22 Percent Year-over-Year

Reports Record Fourth-Quarter Revenue of $14.7 Billion

News Highlights:

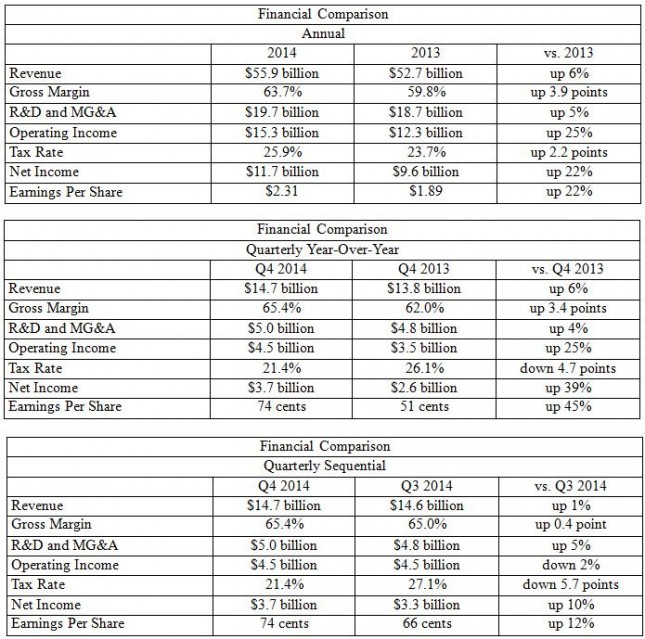

SANTA CLARA, Calif., January 15, 2015 — Intel Corporation today reported full-year revenue of $55.9 billion, operating income of $15.3 billion, net income of $11.7 billion and EPS of $2.31. The company generated approximately $20.4 billion in cash from operations, paid dividends of $4.4 billion, and used $10.8 billion to repurchase 332 million shares of stock.

For the fourth-quarter, Intel posted revenue of $14.7 billion, operating income of $4.5 billion, net income of $3.7 billion and EPS of $0.74. The company generated approximately $5.8 billion in cash from operations, paid dividends of $1.1 billion and used $4.0 billion to repurchase 115 million shares of stock.

“The fourth quarter was a strong finish to a record year,” said Intel CEO Brian Krzanich. “We met or exceeded several important goals: reinvigorated the PC business, grew the Data Center business, established a footprint in tablets, and drove growth and innovation in new areas. There is more to do in 2015. Well improve our profitability in mobile, and keep Intel focused on the next wave of computing. ”

Full-Year 2014 Business Unit Trends

- PC Client Group revenue of $34.7 billion, up 4 percent from 2013.

- Data Center Group revenue of $14.4 billion, up 18 percent from 2013.

- Internet of Things Group revenue of $2.1 billion, up 19 percent from 2013.

- Mobile and Communications Group revenue of $202 million, down 85 percent from 2013.

- Software and services operating segments revenue of $2.2 billion, up 1 percent from 2013.

Q4 Key Business Unit Trends

- PC Client Group revenue of $8.9 billion, down 3 percent sequentially and up 3 percent year-over-year.

- Data Center Group revenue of $4.1 billion, up 11 percent sequentially and up 25 percent year-over-year.

- Internet of Things Group revenue of $591 million, up 12 percent sequentially and up 10 percent year-over-year.

- Mobile and Communications Group negative revenue of $6 million, consistent with expectations.

- Software and services operating segments revenue of $557 million, flat sequentially and down 6 percent year-over-year.

Business Outlook

Intel’s Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after January 15.

Full-Year 2015

- Revenue: growth in the mid-single digit percentage points.

- Gross margin percentage: 62 percent, plus or minus a couple of percentage points.

- R&D plus MG&A spending: approximately $20.0 billion, plus or minus $400 million.

- Amortization of acquisition-related intangibles: approximately $255 million.

- Depreciation: approximately $8.1 billion, plus or minus $100 million.

- Tax rate: approximately 27 percent.

- Full-year capital spending: $10.0 billion, plus or minus $500 million.

Q1 2015

- Revenue: $13.7 billion, plus or minus $500 million.

- Gross margin percentage: 60 percent, plus or minus a couple of percentage points.

- R&D plus MG&A spending: approximately $4.9 billion.

- Restructuring charges: approximately $40 million.

- Amortization of acquisition-related intangibles: approximately $65 million.

- Impact of equity investments and interest and other: approximately zero.

- Depreciation: approximately $1.8 billion.

For additional information regarding Intel’s results and Business Outlook, please see the CFO commentary at: www.intc.com/results.cfm.

Status of Business Outlook

Intel’s Business Outlook is posted on intc.com and may be reiterated in public or private meetings with investors and others. The Business Outlook will be effective through the close of business on December 12 unless earlier updated; except that the Business Outlook for amortization of acquisition-related intangibles, impact of equity investments and interest and other, restructuring charges, and tax rate, will be effective only through the close of business on January 22. Intel’s Quiet Period will start from the close of business on March 13 until publication of the company’s first-quarter earnings release, scheduled for April 14. During the Quiet Period, all of the Business Outlook and other forward-looking statements disclosed in the company’s news releases and filings with the SEC should be considered as historical, speaking as of prior to the Quiet Period only and not subject to an update by the company.

About Intel

Intel (NASDAQ: INTC) is a world leader in computing innovation. The company designs and builds the essential technologies that serve as the foundation for the worlds computing devices. As a leader in corporate responsibility and sustainability, Intel also manufactures the worlds first commercially available conflict-free microprocessors. Additional information about Intel is available at newsroom.intel.com and blogs.intel.com, and about Intels conflict-free efforts at conflictfree.intel.com.