Desktop, Notebook and Tablet Sales Up 25.4 Percent Over 2012

U.S. Commercial Channel Computing Device Sales Set to End 2013 with Double-Digit Growth, According to NPD

PORT WASHINGTON, NEW YORK, DECEMBER 23, 2013 Year to date through November 2013, 14.4 million desktops, notebooks, and tablets were sold through U.S. commercial channels, leading to a 25.4 percent increase over 2012, according to The NPD Groups Distributor Track and Commercial Reseller Tracking Service. This stellar performance follows the 3.1 percent sales increase experienced in 2012

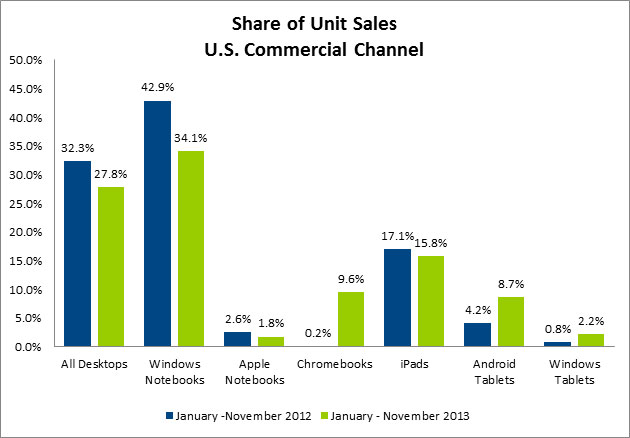

Desktop sales through the channel increased 8.5 percent, notebooks grew 28.9 percent, and tablets jumped 49 percent growth over the same time period in 2012. Windows notebooks* showed no growth over 2012, Windows desktops* increased by nearly 10 percent and Apple sales for notebooks and desktops combined fell by 7 percent.

Chromebooks, and Android tablets collectively had the biggest impact on sales growth, with 1.76 million units going through the channel from January through November of this year, compared to just 400,000 units in 2012.

Chromebooks accounted for 21 percent of all notebook* sales, up from negligible share in the prior year, and 8 percent of all computer and tablet sales through November, up from one tenth of a percent in 2012 the largest share increase across the various product segments.

Tablet sales captured more than 22 percent of all personal computing device sales sold through the commercial channel through November, Windows tablet sales nearly tripled off a very small base, and Android tablet sales grew more than 160 percent. Apple iPad sales accounted for 59 percent of the volume in the tablet market.

The market for personal computing devices in commercial markets continues to shift and change, said Stephen Baker, vice president of industry analysis, NPD. New products like Chromebooks, and reimagined items like Windows tablets, are now supplementing the revitalization that iPads started in personal computing devices. It is no accident that we are seeing the fruits of this change in the commercial markets as business and institutional buyers exploit the flexibility inherent in the new range of choices now open to them.

*Preconfigured desktop and notebook sales only

Source: The NPD Group/Distributor Track and Commercial Reseller Tracking Service

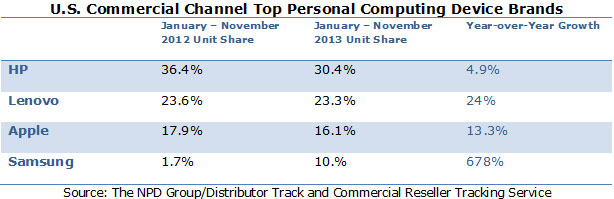

HP led commercial personal computing devices; but even with a 6 percent increase in total notebook sales its small exposure to booming tablet market drove its share down. Lenovo remained the second largest channel vendor with notebook sales up almost 18 percent and, desktops up 30 percent. Even with strong tablet growth of over 200 percent Lenovos overall unit share remained flat as it too suffered from a lack of presence in the tablet segment. Apples dominant position in the tablet market which accounted for more than 80 percent of its commercial sales made it the third largest brand. Samsung, as a result of its rapid expansion of Chromebook and Android tablet sales, was ranked number four.

Tepid Windows PC sales allowed brands with a focus on alternative form factors or operating systems, like Apple and Samsung, to capture significant share of a market traditionally dominated by Windows devices, said Baker. Yet the Windows PC in commercial channels is clearly not dead, and its biggest brand proponents, HP and Lenovo, remain deeply committed to that product. However, as businesses upgrade from older machines and operating systems in the year ahead, the long-term trend is clearly towards greater hardware diversity, which all manufacturers will need to embrace in order to continue to grow.*Preconfigured desktop and notebook sales only