AMD Reports 2015 Second Quarter Results

AMD Reports 2015 Second Quarter Results

SUNNYVALE, Calif. 7/16/2015

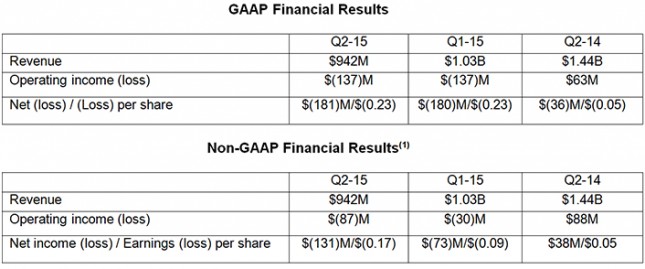

AMD (NASDAQ:AMD) today announced revenue for the second quarter of 2015 of $942 million, operating loss of $137 million, and net loss of $181 million, or $0.23 per share. Non-GAAP1 operating loss was $87 million and non-GAAP1 net loss was $131 million, or $0.17 per share.

Strong sequential revenue growth in our EESC segment and channel business was not enough to offset near-term challenges in our PC processor business due to lower than expected consumer demand that impacted sales to OEMs, said Dr. Lisa Su, AMD president and CEO. We continue to execute our long-term strategy while we navigate the current market environment. Our focus is on developing leadership computing and graphics products capable of driving profitable share growth across our target markets.

Q2 2015 Results

- Revenue of $942 million, down 8 percent sequentially and 35 percent year-over-year. The sequential decrease was primarily due to weaker than expected consumer PC demand impacting the companys Original Equipment Manufacturer (OEM) APU sales. The year-over-year decline was primarily due to decreased sales across client and graphics product lines.

- Gross margin of 25 percent, down 7 percentage points sequentially, primarily due to a higher mix of Enterprise, Embedded and Semi-Custom segment sales, lower than anticipated Computing and Graphics segment APU unit volumes, and a charge of approximately $33 million associated with a technology node transition from 20 nanometer (nm) to FinFET. Non-GAAP1gross margin, excluding the impact of the $33 million charge was 28 percent.

- Operating loss of $137 million, compared to an operating loss of $137 million for the prior quarter. Non-GAAP1 operating loss of $87 million, compared to non-GAAP1 operating loss of $30 million in Q1 2015, primarily due to lower revenue and gross margin driven by lower sales to OEMs attributable to a weak consumer PC market.

- Net loss of $181 million, loss per share of $0.23, and non-GAAP1 net loss of $131 million, non-GAAP1 loss per share of $0.17, compared to a net loss of $180 million, loss per share of $0.23 and non-GAAP1 net loss of $73 million, non-GAAP1 loss per share of $0.09 in Q1 2015.

- Cash, cash equivalents, and marketable securities were $829 million at the end of the quarter, down $77 million from the end of the prior quarter.

- Total debt at the end of the quarter was $2.27 billion, flat from the prior quarter.

Financial Segment Summary

- Computing and Graphics segment revenue decreased 29 percent sequentially and 54 percent from Q2 2014. The sequential decrease was primarily due to decreased sales to OEMs of client notebook processors and the annual decrease was driven by decreased sales across client and graphics product lines.

- Operating loss was $147 million, compared with an operating loss of $75 million in Q1 2015 and an operating loss of $6 million in Q2 2014. The sequential decrease was primarily driven by lower notebook processor sales. The year-over-year decrease was primarily driven by lower sales partially offset by lower operating expenses.

- Client average selling price (ASP) increased sequentially and year-over-year primarily driven by product mix.

- GPU ASP increased sequentially and year-over-year primarily due to higher channel and desktop GPU ASPs.

- Enterprise, Embedded and Semi-Custom segment revenue increased 13 percent sequentially, primarily driven by higher sales of semi-custom SoCs. The year-over-year decrease of 8 percent was primarily driven by decreased server sales and lower non-recurring engineering (NRE) revenue.

- Operating income was $27 million compared with $45 million in Q1 2015 and $97 million in Q2 2014. The sequential decrease was primarily driven by the technology node transition charge of $33 million. The year-over-year decrease was primarily driven by lower revenue and the technology node transition charge.

- All Other category operating loss was $17 million compared with operating losses of $107 million in Q1 2015 and $28 million in Q2 2014. The sequential improvement was primarily due to charges in Q1 2015 associated with exiting the dense server systems business. The year-over-year change was primarily due to lower stock-based compensation expense and the absence of amortization of acquired intangible assets.

Recent Highlights

- At its 2015 Financial Analyst Day event, AMD outlined a multi-year strategy to drive profitable growth based on delivering a broad set of high-performance, differentiated products across the key areas of gaming, immersive platforms, and the datacenter. AMD also provided a product roadmap update that included its upcoming x86 processor core (codenamed Zen) for high-performance client and server computing.

- AMD announced that Jim Anderson joined the company as senior vice president and general manager of AMDs Computing and Graphics (CG) business group, responsible for managing all aspects of strategy, business management, engineering, and sales for AMDs computing and graphics products and solutions.

- AMD was named to the Fortune 500 List for the 15th year in a row.

- AMD demonstrated technology leadership with the introduction of the industrys first graphics chip to combine die-stacked high-bandwidth memory (HBM) with its new flagship AMD Radeon R9 Fury X GPU, which delivers 60 percent more memory bandwidth and 4x the performance-per-watt of GDDR5 memory2. AMD also announced a full family of new Radeon R9 and Radeon R7 Series graphics cards as well as the AMD Radeon 300 and M300 Series Graphics.

- AMD announced the AMD 6th Generation A-Series mobile processors, delivering a significant 2.4x improvement in energy efficiency over previous generation processors3 and 2x the gaming performance of competing platforms4. AMD also introduced the latest addition to its line of desktop A-Series processors, the AMD A10-7870K APU, providing a best-in-class experience for eSports and online gaming. All new APUs are designed for the future with Microsoft Windows 10 compatibility.

- AMD expanded its leadership position in virtual reality (VR) as technology partners continue to realize the benefits of AMD LiquidVR technology across a variety of industries, including education, entertainment, gaming, and medical research.

- AMD continued to build on its No. 1 position in the thin client space with new designs introduced from HP and Samsung, both powered by the AMD Embedded G-Series SoC.

- AMD drove continued momentum for its AMD FirePro professional graphics with new design wins and support in key vertical categories, including:

- Powering one of the worlds largest and most technologically advanced display walls, located in New Yorks Times Square.

- Delivering certified support for both the Windows and Mac versions of Avid Media Composer 8.4, the industry-leading video editing application for HD and 4K broadcast and digital content creation.

- AMD demonstrated its commitment to leadership in HPC with the announcement that the University of Warsaws new ORION supercomputer cluster uses 150 Dell PowerEdge R730 servers each featuring 2 AMD FirePro S9150 server GPUs to deliver a GPU peak compute performance of 1.52 petaFLOPS single precision and 0.76 petaFLOPS double precision for OpenCL applications5.

- At the Red Hat Developer Summit, AMD extended its efforts to grow the ARM-based server ecosystem by showcasing new 64-bit ARM development platforms from Linaro and SoftIron featuring the AMD Opteron A1100 Series processor (codenamed Seattle).

Current Outlook

AMDs outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under Cautionary Statement below.

For Q3 2015, AMD expects revenue to increase 6 percent, plus or minus 3 percent, sequentially.

For additional details regarding AMDs results and outlook please see the CFO commentary posted atquarterlyearnings.amd.com.AMD Teleconference

AMD will hold a conference call for the financial community at 2:30 p.m. PDT (5:30 p.m. EDT) today to discuss its second quarter financial results. AMD will provide a real-time audio broadcast of the teleconference on the Investor Relations page of its website at www.amd.com. The webcast will be available for 12 months after the conference call.

About AMD

For more than 45 years, AMD has driven innovation in high-performance computing, graphics, and visualization technologies the building blocks for gaming, immersive platforms, and the datacenter. Hundreds of millions of consumers, leading Fortune 500 businesses, and cutting-edge scientific research facilities around the world rely on AMD technology daily to improve how they live, work, and play. AMD employees around the world are focused on building great products that push the boundaries of what is possible. For more information about how AMD is enabling today and inspiring tomorrow, visit the AMD (NASDAQ: AMD) website, blog, Facebook and Twitter pages.